Smart Beta mutual funds are making headlines nowadays. Asset Management Companies (AMCs) are vying to introduce new funds focusing on factor-based investing. Thirty-one of the 81 smart beta funds were launched in less than a year.

In India, AMCs launch smart beta funds tracking group of stocks that are picked based on the factors (either single or combination) such as quality, value, alpha, low volatility, momentum and equal weight. The overall asset under management of these smart beta funds as of November 30, 2024 was ₹37,762 crore. The largest fund in the segment is UTI Nifty200 Momentum 30 Index Fund managing the asset of ₹8,334 crore.

Smart beta investing combines the prowess of active and passive into one. The goal is to get higher returns than the traditional market capitalisation-based indices. Smart beta mutual fund schemes passively track the indices that are culled out from the conventional indices using a variety of fundamental, technical and other filters by the NSE and the BSE.

For instance, The Nifty 100 Low Volatility 30 index tracks the performance of 30 stocks in Nifty 100 with the lowest volatility in the last one year. Standard Deviation is used to shortlist the stocks.

Cyclical nature

Both single-factor and multi-factor smart beta funds have been introduced by mutual funds in India.

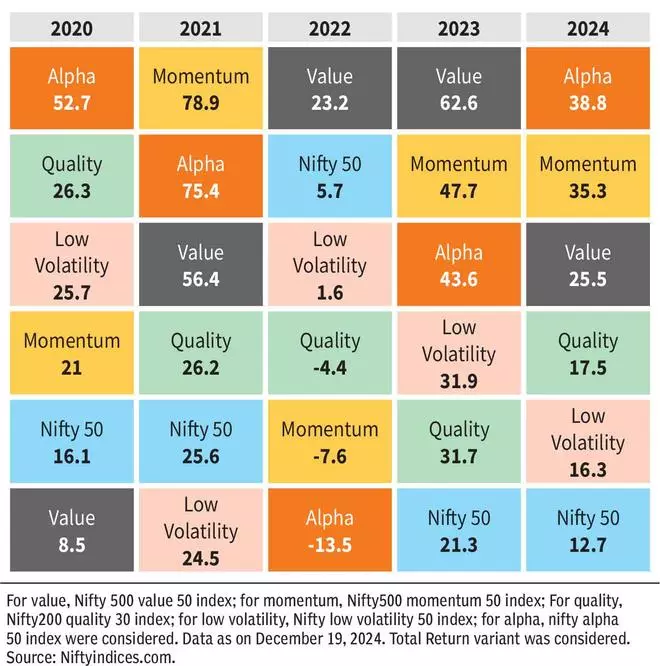

Performance of smart beta funds is cyclical; they perform well at times and underperform during other times. For instance, the value strategy works well particularly during recovery phases. Low volatility stands to gain during uncertainties while quality performs well during volatile or bear market cycles. Momentum gains its spot during a strongly trending bull market.

Alpha tops chart

The year 2024 was marked with the alpha factor that outpaced the other factor indices and the broader market indices with huge margins. Alpha strategy captures the stocks that have performed well recently and are expected to continue to outperform in the short to medium term.

The primary index for the alpha strategy, the Nifty Alpha 50 index, measures the performance of the top 50 stocks in terms of higher alpha chosen from the universe of 300 companies. Simply put, Alpha is an excess return generated by the stock against the market return. One of the reasons for the outperformance of the strategy was higher weight to the financial services sectors that constitutes 20 per cent of the index, which has a lot of PSU names that delivered relatively higher returns.