Equity mutual funds that bet on the manufacturing theme have demonstrated notable performance over the last two years. In 2024, it was among the top performing categories. The category delivered 26 per cent in 2024 while the broader index Nifty 500 total return index (TRI) posted 16 per cent.

Asset management companies have queued up to launch new schemes in the category lately. In the past 12 months, eight out of 17 schemes were introduced. Twelve of the schemes are actively managed, while four are passive schemes.

Only three – Aditya Birla Sun Life Manufacturing Equity, Bank of India Mfg & Infra and ICICI Prudential Manufacturing – have a track record of more than five years. The assets under management of the category as of November 2024 were worth ₹37,686 crore.

In 2024, Axis India Manufacturing fund topped the return chart with 33 per cent, followed by Kotak Manufacture in India and Bank of India Mfg & Infra that clocked returns of 25.7 per cent and 25.5 per cent respectively. Overweight positions in auto, capital goods and pharmaceuticals contributed to the better performance of these schemes.

A semi-diversified theme

These schemes try to capitalise on manufacturing trends and opportunities, investing across relevant sectors.

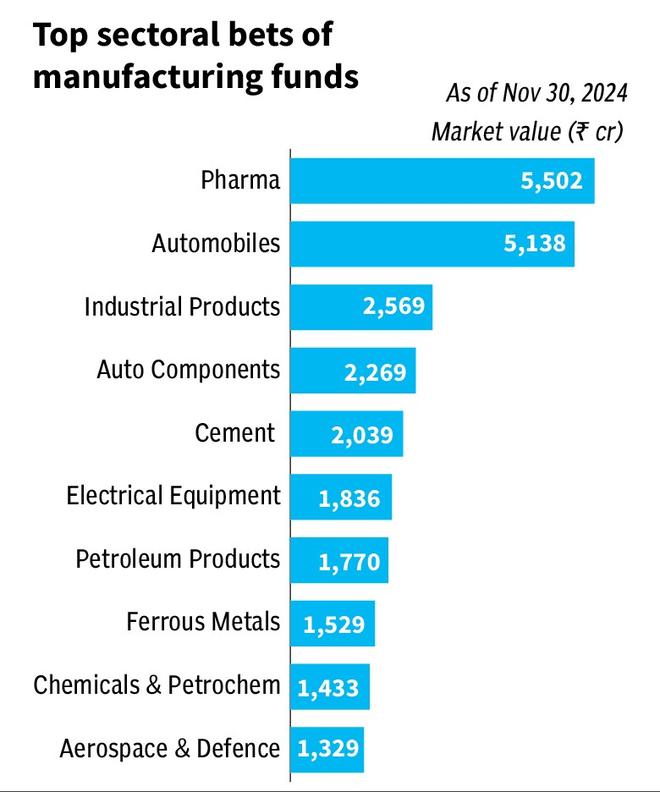

They bet on multiple industries largely encompassing 11 sectors including Automobiles & Auto ancillary, Chemicals, Pharmaceuticals, Capital goods and Engineering, Food & beverages, Textiles, Consumer durables, Building materials, Defence & aerospace and Industrials.

The stocks under these sectors are likely to benefit especially from the Indian government’s reform initiatives such as Make in India, that have been instrumental in fostering a favourable business environment, encouraging investment, and promoting indigenous manufacturing. Make in India, Industrial corridor development programme, PM Gati Shakti, PLI schemes and atmanirbhar Bharat are likely to increase manufacturing’s contribution to GDP. Such initiatives alongside labour and tax reforms and the opportunities arising from China +1 augur well for medium-term growth of the manufacturing theme in India.

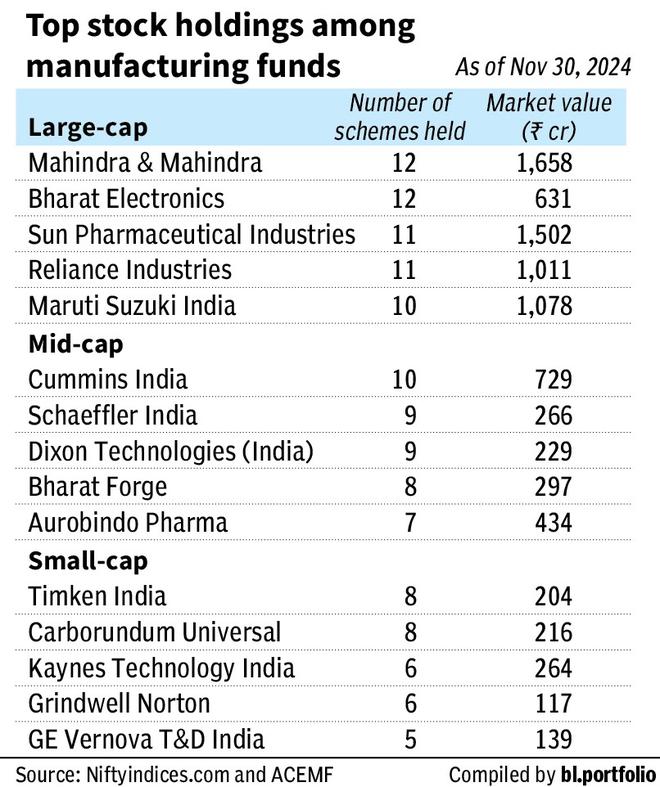

Each scheme in the category follows its own philosophy in picking stocks that are engaging in manufacturing activities. All follow a bottom-up approach, picking stocks across market capitalisation.

For instance, per the current strategy, Axis India Manufacturing looks for companies that are benefiting mainly from import substitution and focusing on export opportunities, while Kotak Manufacture in India bets big on auto & auto ancillary, pharmaceuticals, capital goods and metals.

As far as the market capitalisation segments allocation is concerned, HDFC Manufacturing, ICICI Pru Manufacturing and Kotak Manufacture in India manage a large-cap oriented portfolio while the schemes such as Motilal Oswal Manufacturing, LIC MF Manufacturing and Invesco India Manufacturing hold a mid and small-cap heavy portfolio as of November 2024.

HDFC Manufacturing, ICICI Pru Manufacturing, and Axis India Manufacturing funds have spread their investments throughout more than 80 stocks. Meanwhile Quant Manufacturing and Motilal Oswal Manufacturing have a concentrated approach of investing in 30 stocks.

Is a repeat possible?

While explaining on the outlook for the theme, Harsha Upadhyaya, CIO Equity said, “The outlook for the manufacturing sector in the country continues to be strong given renewed thrust from the government through conducive policy push, growing domestic demand across segments in line with growing economy and increasing export opportunities, availability of low-cost and skilled labour, large consumer base, so on and so forth”.

However, when interest rates are higher and inflation is shooting up, the manufacturing theme may fare poorly.

Investors should keep in mind that sector and thematic funds are cyclical in nature. They are risky investments as they may fall into prolonged underperformance over a long period of time. Note that the manufacturing theme delivered suboptimal returns from 2019 to 2022, despite their strong performance in 2023 and 2024.

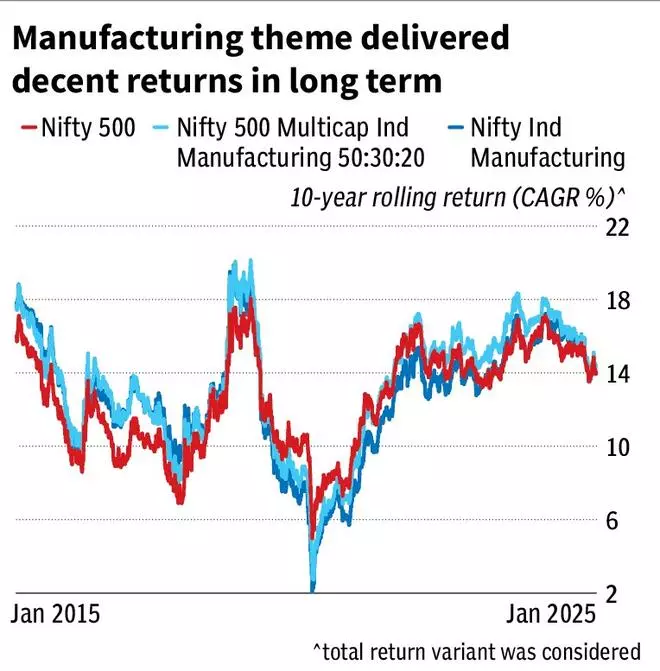

However, over the long run, the manufacturing theme delivered decent returns. Performance as measured by the 10-year rolling returns calculated from the last 20 years data shows that the Nifty India manufacturing TRI delivered a compounded annualised return of 12.7 per cent while the Nifty 500 TRI gave 12.5 per cent. Meanwhile, the other index, Nifty500 Multicap India Manufacturing 50:30:20 TRI gave 13.3 per cent during the period.

Majority of manufacturing-focused schemes have a short track-record of less than three years and are yet to prove their mettle.

High-risk investors who are well-versed in equity market dynamics can consider investing a small portion in these schemes. The minimum time horizon would be seven years and more.