Mutual funds (MF) have become the go-to investing option for retail as well as large investors ever since the Unit Trust of India, the country’s first mutual fund scheme was launched almost 60 years ago.

MFs have rewarded the patience of long-term investors handsomely. They are a power vehicle to participate in the equity markets. Well-managed equity-oriented schemes have proved with their long-term track records that wealth can be built over the long term.

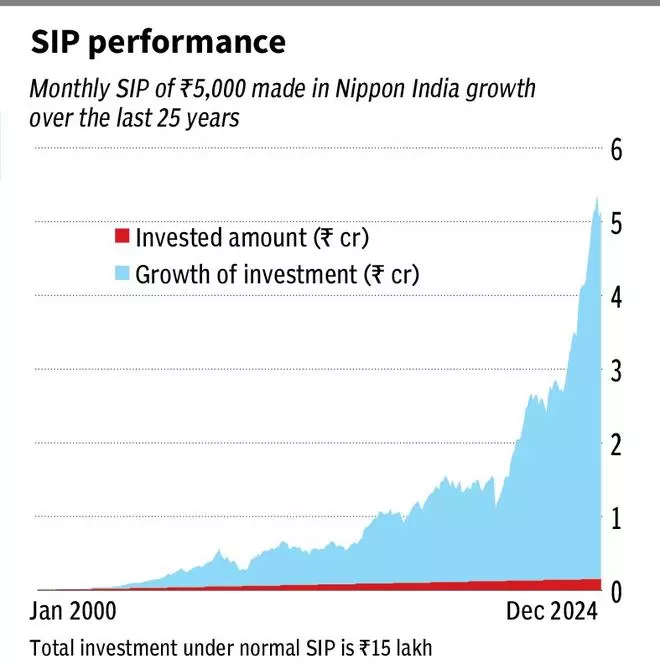

Data compiled from the ACEMF show that the top-performing equity schemes multiplied the monthly investment of ₹5,000 made over the last 25 years up to₹5 crore. Systematic Investment Plan (SIP) enables investors to make recurring investments in mutual fund schemes.

The accompanying table shows that you would presently be sitting on a corpus worth between ₹2.5 crore and ₹4.98 crore if you had invested ₹5,000 a month through the systematic route for 25 years in these schemes.

According to the table, as of December 31, 2024, the top-performing scheme Nippon India Growth Fund has returned ₹4.98 crore for the 25-year SIP. Remarkably, as of October 2024, it had reached ₹5 crore.

SIP works well in long term

Indian investors are now more acquainted with the benefit of SIP to invest in MF schemes. Now, more than ₹25,000 crore is the monthly SIP contribution in MFs, which is expected to increase in the future. SIP enables you to regularly invest small sums in MFs to build wealth and reach your financial goals.

SIP helps in reaching your long-term financial objectives, including retirement and your children’s education. As shown in the table, you can accumulate a huge corpus by allocating a lesser amount over time.

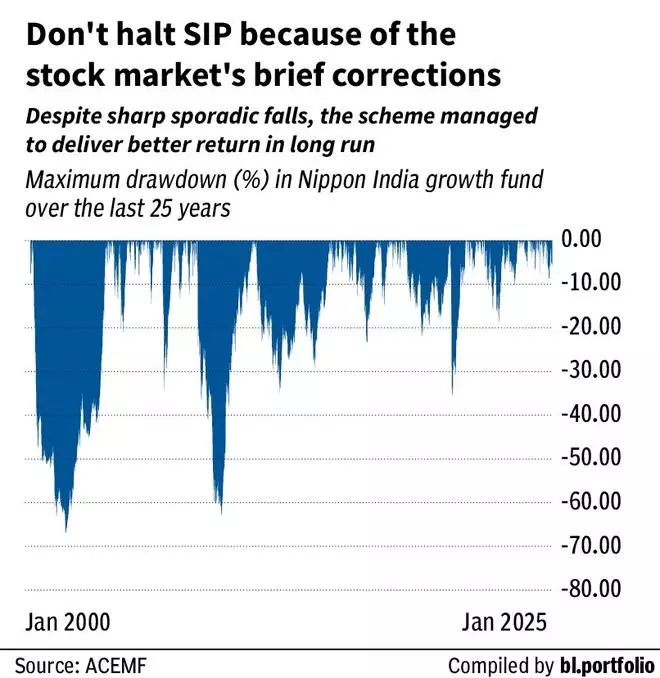

Keep in mind that you should not stop your SIP due to the short-term blips in the stock market that deter you. The accompanying drawdown chart exhibits the largest declines in the NAV value of Nippon India growth fund from their respective previous peaks in the last 25 years. Even though the scheme saw significant declines, it ultimately produced an impressive return over the long run.

Ideally, SIP helps you in riding out the market volatility well. Such volatility gives you the opportunity to reduce the average cost per unit by buying more units when prices are low and fewer units when prices are high. This will help accumulating more units and achieving the better returns.

Stepping up the SIP

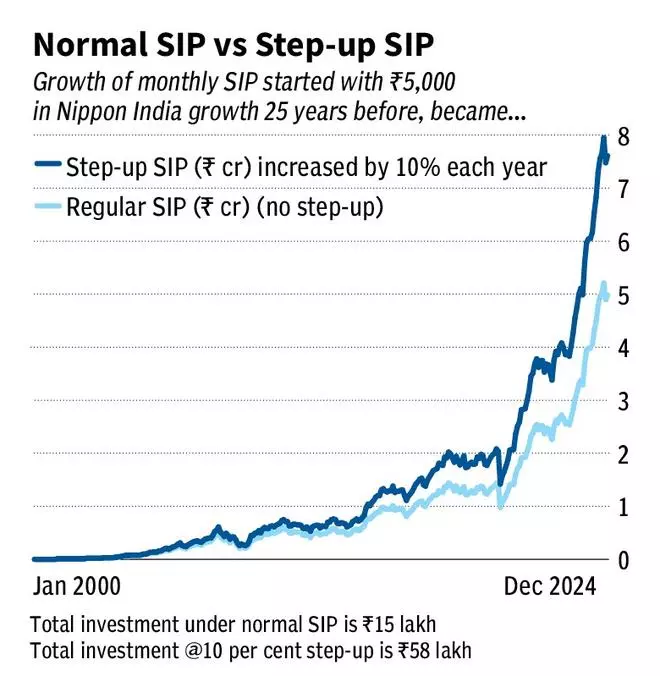

Mutual fund companies provide a variety of SIP options to help you accumulate a sizeable corpus and achieve your financial objectives at the earliest. One of these is ‘step-up SIP’, which differs marginally from ‘regular SIP’.

Under regular SIP, you invest a fixed amount at a regular interval. The step-up SIP allows you to gradually increase your contributions, which are in direct proportion to your rising income. It makes use of your rising income to build a larger corpus in a relatively brief span of time.

Step-up SIPs are especially advantageous for salaried individuals who get regular salary hikes or bonuses. As your salary increases annually, it is always a good idea to increase your contributions once a year.

For instance, the regular SIP of ₹5,000 per month in Nippon India growth fund fetched you a corpus of ₹4.98 crore in 25 years. But when you increase the monthly SIP by 10 per cent each year, the corpus would become ₹7.6 crore. Your total investment would be ₹59 lakh (10 per cent step-up annually) compared to ₹15 lakh (no step-up).

With 10 per cent annual step-up, the SIP has grown significantly, as compared to regular SIP. Data show that the step-up SIP delivered higher returns than the normal SIP under most circumstances (except those in a prolonged bear market).