HDFC Bank’s FY25 annual profit grew 11 per cent on-year to ₹67,347 crore.

| Photo Credit:

SHAILESH ANDRADE

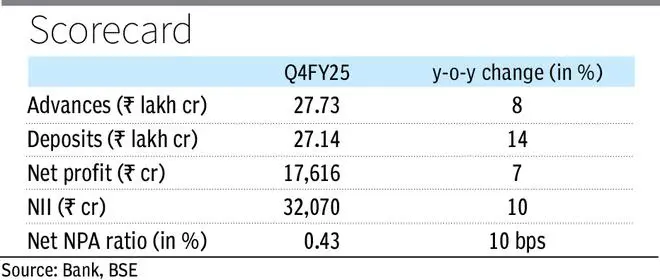

Largest private sector lender HDFC Bank today reported its Q4FY25 net profit at ₹17,616 crore, up 7 per cent year-on-year (y-o-y), led by stable growth in net interest income (NII) and lower provisions.The bank’s FY25 annual profit grew 11 per cent on-year to ₹67,347 crore.

HDFC Bank’s overall advances were up 8 per cent on-year to ₹27.73 lakh crore as on March end. Overall deposits, meanwhile, rose 14 per cent y-o-y to ₹27.14 lakh crore. In FY26, the bank aims to grow its loan book in-line with industry growth and lower its credit-deposit (CD) ratio to pre-HDFC merger level of 85-90 per cent by FY27, from 97 per cent in March and 104 per cent a year ago. The competition on pricing in corporate and mortgage loans continues to be high, the management said. Net interest income (NII) grew 10 per cent on-year to ₹32,070 crore in Q4.

Net interest margin (NIM) rose slightly by 3 basis points (bps) in Q4 to 3.46 per cent. “You have to look at it (NIM) over a year or longer period, where you will see that there is a stability in margin, with a bias for upward, as we start to pare down the borrowings and replace it with deposits,” said Srinivasan Vaidyanathan, CFO, HDFC Bank.

Asset quality improved sequentially, with gross and net non-performing asset ratio (GNPA, NNPA) contracting by 9 bps and 3 bps on-quarter to 1.33 per cent and 0.43 per cent, respectively as on March end.As asset quality improved, provisions fell 76 per cent on-year to Rs 3,190 crore in Q4.

According to the bank management, the lender is awaiting approval from the Securities and Exchange Board of India for listing its non-bank arm HDB Financial Services. Per regulatory guidelines, the NBFC arm has to be listed by September 2025.

More Like This

Published on April 19, 2025