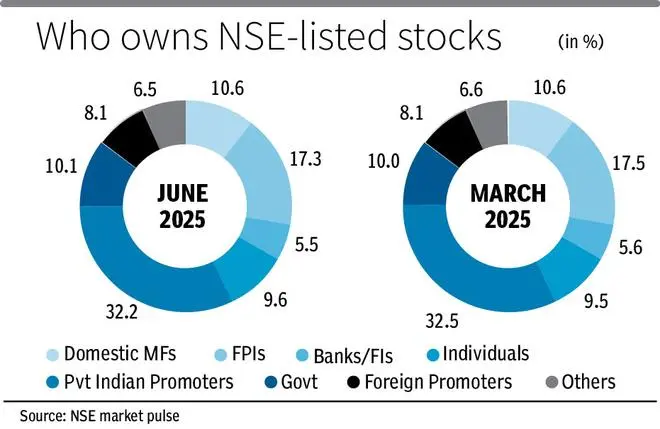

In sharp contrast, domestic mutual funds climbed to a fresh record share of 10.6 per cent in NSE-listed companies, and 13 per cent in the Nifty 50

The balance of power in India’s equity markets continues to tilt toward domestic investors, with the promoter ownership in listed companies sliding to fresh lows while retail and mutual fund participation continues to hit new peaks.

According to NSE’s latest Market Pulse report, promoter stakes across NSE-listed companies fell for the fourth straight quarter to 50.4 per cent in June 2025, the lowest in nine quarters. While that in Nifty 50 saw a sharper decline to a 23-year low of 40.2 percent— mainly due to a decline in private Indian and government promoters .

At the same time, the government’s share in listed companies showed a mixed trend — inching up modestly in the broader market to 10.1 per cent but slipping in the Nifty 50 to 6.7 per cent, its lowest level in six quarters. The uptick in the broader universe was aided by PSU banks’ strong performance, with the Nifty PSU Bank Index rising 15 per cent in the June quarter.

FPIs prefer Nifty

Foreign portfolio investors (FPIs) have continued to cut their overall stake due to global volatility, down to 17.3 per cent – the lowest in 13.5 years. Their portfolios became more concentrated in financials and communication services, while remaining cautious on staples, energy, materials, and staying bearish on industrials.

However, FPIs showed a clear preference for scale and resilience, lifting their ownership in the Nifty 50 to a six-quarter high of 24.5 per cent. Their holding in Nifty 500 stayed broadly steady at 18.5 percent.

MFs surge

In sharp contrast, domestic mutual funds (DMFs) climbed to a fresh record share of 10.6 per cent in NSE-listed companies, and 13 per cent in the Nifty 50. This was powered by strong retail participation through systematic investment plans (SIPs), which averaged ₹26,863 crore a month in Q1FY26 — up nearly 29 per cent from a year earlier.

Active funds expanded their share to 8.6 percent, while passive funds held steady at 1.9 per cent. DMFs have also realigned closer to benchmark indices: trimming overweight exposure to large financials, easing their underweight stance on consumer staples, and turning positive on materials and smaller consumer durables, even as they grew cautious on energy.

For the third consecutive quarter, domestic institutional ownership stayed ahead of FPIs, widening the lead to levels not seen since 2003.

Retail rise

Individual investors’ direct ownership ticked up to 9.6 per cent, led by continued preference for mid- and small-cap stocks. While they registered net outflows of ₹13,136 crore during the quarter, the rotation toward smaller companies kept their overall share intact.

When combined with mutual fund investments, retail investors now own a record 18.5 per cent of market capitalisation, surpassing FPIs for the third straight quarter. Just a decade ago, in March 2014, FPIs commanded an 11 percentage point lead over households— a gap that has not only closed but turned negative at -1.2 percentage points this June.

Published on August 25, 2025