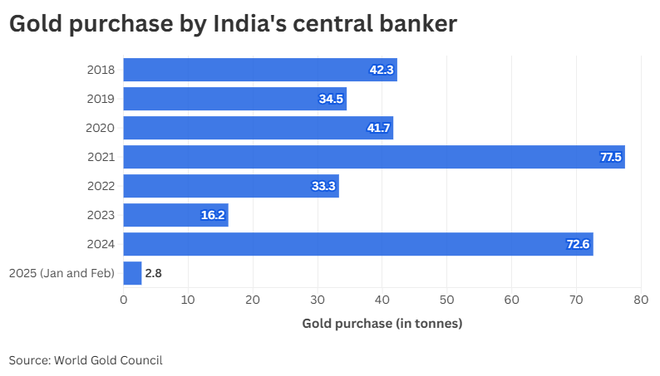

RBI was active throughout the year, purchasing gold in 11 of the 12 months and adding another 2.8 tonnes in the first two months of 2025.

| Photo Credit:

iStockphoto

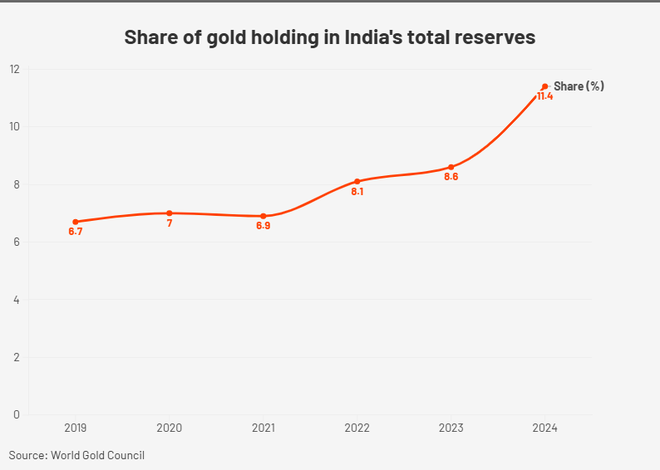

As gold prices surge to historic highs on the back of heightened geopolitical uncertainty, data shows that India’s central bank, the Reserve Bank of India, has been an aggressive buyer in the last year, and the share of gold in India’s total reserves has almost doubled.

RBI has emerged as the second-highest central bank in the world when it comes to purchasing gold. Data from World Gold Council shows that India bought 72.6 tonnes of gold in the calendar year 2024, raising its total gold reserves by 9 per cent. This was the second-highest among all the central banks. RBI bought gold in 11 out of the 12 months of the year.

The gold quantity bought in 2024 is also over four times the amount it bought in 2023 – 16 tonnes. Prior to this, India bought this level of gold in the past seven years in 2021, when RBI purchased 77.5 tonnes. In 2025 (January and February), India has already bought 2.8 tonnes of gold.

Poland was the top buyer in 2024, expanding its reserve by 25 per cent with 89.54 tonnes of gold. Turkey also added 74.8 tonnes, which includes domestic commercial banks depositing their gold at the central bank.

The share of gold holdings in India’s total reserves has also sharply risen. This share was at 6.7 per cent at the end of 2019, 7 per cent in 2020, 6.9 per cent in 2021, 8.1 per cent in 2022, 8.6 per cent in 2023 and 11.4 per cent in 2024.

Some central banks also reduced their gold reserves in 2024, with the Philippines at the top. Analysts note that countries typically sell some of their gold holdings in response to economic pressures or to ensure liquidity in volatile markets.

According to WGC data for April, the US, Germany, Italy, France, and Russia hold the highest quantities of gold reserves.

The gold price peaked at US$3,245, its all-time high, during trading on April 14, 2025. With US President Donald Trump’s tariff hikes increasing concerns of a potential global trade war, more investors have sought refuge in safe-haven assets like gold. Gold price analysis shows that just since Trump’s inauguration on January 20 alone, the price of gold has surged by over 8 per cent.

Overall, Central banks had a high appetite for gold in 2024. The net annual total of gold reserves added by Central banks worldwide stood at 1,045 tonnes in 2024.

“As a result, they have extended their buying streak to 15 consecutive years, and, remarkably, 2024 is the third consecutive year in which demand surpassed 1,000 tonnes,” the WGC said in a recent report. “Following the colossal buying in 2022 and 2023, net purchases in 2024 surpassed our expectations. Geopolitical and economic uncertainty remains high in 2025 and it seems as likely as ever that central banks will once again turn to gold as a stable strategic asset,” WGC added.

More Like This

Published on April 17, 2025