Nifty 50, Sensex and the Nifty Bank index fell for the fifth consecutive week and were down just over a per cent each. The Nifty Midcap 150 and the Nifty Smallcap 250 indices were beaten down badly. They were down 1.92 and 2.97 per cent respectively.

Among the sectors, the BSE FMCG, up 2.41 per cent was the only index to close in green. The BSE Reatly index tumbled the most by 5.68 per cent.

The sharp fall in the US markets on Friday after the weak jobs data can drag the Indian benchmark indices further lower. However, we reiterate that this fall is just a correction within the overall uptrend. As such more fall from here should be considered as a good buying opportunity.

FPIs sell

Foreign Portfolio Investors (FPIs) sold heavily last week. The Indian equity segment saw a net outflow of about $2 billion last week. The FPIs have to start buying in order to provide some breather for the benchmark indices.

Nifty 50 (24,565.35)

Nifty struggled to get a strong follow-through rise above 24,900 last week. It touched a low of 24,535.05 on Friday and closed at 24,565.35, down 1.09 per cent.

Short-term view: The trend is down. Immediate support is at 24,450. A bounce from there can take the Nifty up to 24,900 and 25,000.

But a break below 24,450 can drag the Nifty down to 24,300 or 24,000. Cluster of supports are there in the 24,300-24,000 region. So, a fall beyond 24,000 is unlikely. So, Nifty can rise back anywhere from the 24,300-24,000 region and go up to 25,000-25,100

Chart Source: TradingView

Medium-term view: The broader trend is up. Strong support is in the 24,000-23,500 region. We retain our bullish view of seeing a rise to 28,000-28,500 first and then a corrective fall to 26,000. Thereafter Nifty can rise back and target 31,000 over the long-term.

So, the fall to 24,000, if seen, will be a very good buying opportunity.

Video Credit: Businessline

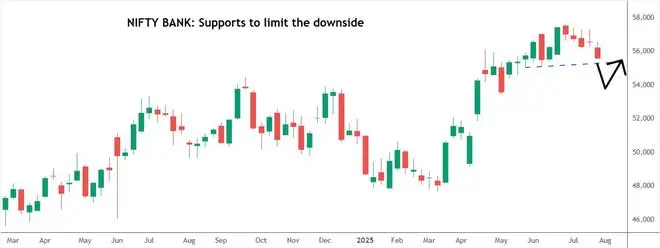

Nifty Bank (55,617.60)

Nifty Bank index fell below 55,950 contrary to our expectation. It made a low of 55,562.10 and closed at 55,617.60, down 1.61 per cent for the week.

Short-term view: The outlook is negative. Nifty Bank index can break 55,300, the immediate support and fall to 54,800-54,500 or even 54,000. However, a fall beyond 54,000 is unlikely. A fresh leg of rise from the 54,500-54,000 region can take the Nifty Bank index up to 56,000-56,500. It will also give an early sign of the resumption of the broader uptrend.

Chart Source: TradingView

Medium-term view: The uptrend is intact with strong support around 54,000. The expected bounce from 54,000 will keep our bullish view intact to see 59,000 over the medium term. A corrective fall to 56,000 is possible thereafter followed by a fresh rally to target 61,000 over the long term.

A sustained fall below 54,000 will only negate this bullish view and drag the index down to 52,500-52,000. But that looks less probable.

Sensex (80,599.91)

The fall to 80,400-80,350 mentioned last week is happening now. Sensex made a low of 80,495.57 and closed the week at 80,599.91, down 1.06 per cent.

Short-term view: Sensex can fall to test its next supports at 79,700 or even 79,000-78,800. A bounce from either of these supports can give a relief bounce to 80,000 initially and then to 82,000 eventually.

A break below 78,800, though less likely, will increase the danger of seeing an extended fall to 77,000 and even lower. So, watch the price action around 79,000 closely.

Chart Source: TradingView

Medium-term view: The expected bounce from around 79,000 will keep the broader bullish view intact. In that case, our bullish view of seeing 88,000-89,000 over the medium term and 91,000-92,000 over the long term will remain alive.

This bullish outlook will come under threat if the Sensex breaks below 78,800. Such a break will drag the index down 76,000.

Nifty Midcap 150 (21,088.65)

The Nifty Midcap 150 index fell breaking below the support at 21,400. This has opened the doors for more fall going forward,

Chart Source: TradingView

The short-term outlook is negative to see a fall to 20,650 and even to 20,200-20,000. The region between 20,200 and 20,000 is a strong support from where the index can rise back to 21,000-21,500 in the short term.

That will also keep the long-term bullish view intact to breach the 22,000-22,100 resistance zone. Such a break can trigger a fresh rally to 23,000-23,500 first and then 25,000-25,500 eventually over the long term.

Nifty Smallcap 250 (16,863.25)

The Nifty Smallcap 250 index has declined below 17,200 contrary to our expectation. There is room to test 16,650-16,550 in the near term. A bounce from the 16,650-16,550 region can take the index back up to 17,500 and 18,000.

Chart Source: TradingView

Such a rise will indicate a possible inverted head and shoulder bullish pattern on the chart. It will also keep our broader bullish view intact to breach the 18,000-18,200 resistance zone and rise to 21,000 over the long term.

In case the index declines below 16,550, it can see an extended fall to 16,300-16,250.

Published on August 2, 2025