Large-cap funds have long anchored equity investing, though recent years have tested this as mid- and small-cap funds stole the limelight. For retail investors seeking steady compounding and controlled volatility, large-cap funds provide the comfort of investing in India’s most established businesses and serve as the core of a long-term portfolio.

At a time when earnings growth is normalising and valuations in mid- and small-caps look stretched, a disciplined large-cap fund provides balance. SBI Large Cap Fund, formerly SBI Bluechip, is one of the most seasoned offerings in the segment.

With assets of over ₹52,000 crore, it is the second largest in the category and has been around since 2006. The size and scale lend liquidity and stability, while the long track record of nearly 20 years, allows investors to judge its performance across cycles.

Approach

SBI Large Cap Fund stands out for its disciplined, quality-oriented style. The portfolio leans on financially sound companies with strong balance sheets and avoids speculative bets, giving it a more defensive character compared to some peers that run aggressive momentum strategies. Its slight bias towards quality (portfolio P/E of 40.8 vs 38.7 for category) has meant the fund may lag during euphoric rallies but tends to cushion investors better in down markets.

Stock selection is spread across 40–50 names, with lower concentration in the top holdings than many peers, reducing volatility. Importantly, after a change in the fund’s management team in April 2024, performance has remained largely steady, suggesting the process remains intact.

The fund sticks firmly to its mandate, with close to 88 per cent in large-caps as of August 2025. Mid-cap exposure is used sparingly, generally within a 9–14 per cent band, and small-cap allocations rarely cross 2 per cent. This discipline differentiates SBI Large Cap from some peers that have strayed into mid-caps more aggressively to chase returns. Over the past five years, its large-cap allocation has dipped to around 80 per cent but has reverted quickly, reinforcing its positioning as a core large-cap fund.

Returns

Performance over long periods has been respectable, if not flashy. The direct plan has delivered a 5-year CAGR of 19.6 per cent, slightly ahead of both benchmark and category averages. The 10-year record at 13.6 per cent is higher than the category. On shorter timeframes, the fund has occasionally trailed some peers that run higher mid-cap risk, but this is consistent with its conservative style.

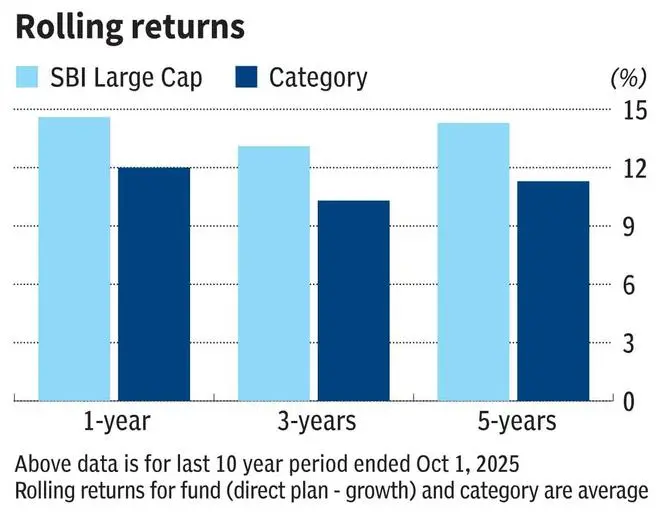

On rolling return metrics, SBI Large Cap has outperformed large-cap fund category average in one-, three- and five-year periods, underscoring consistency across market cycles.

Portfolio

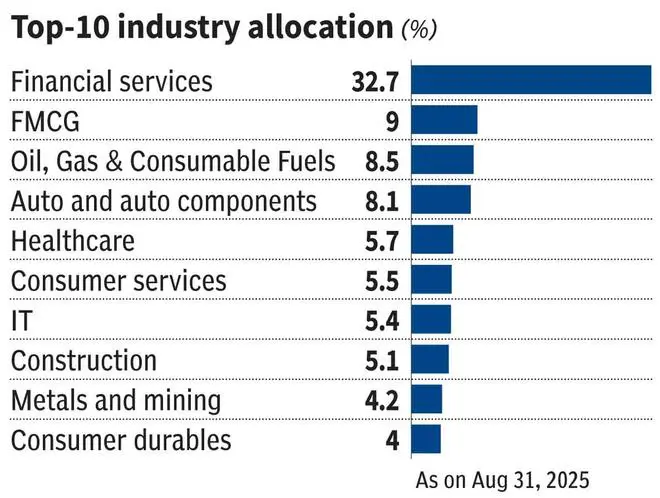

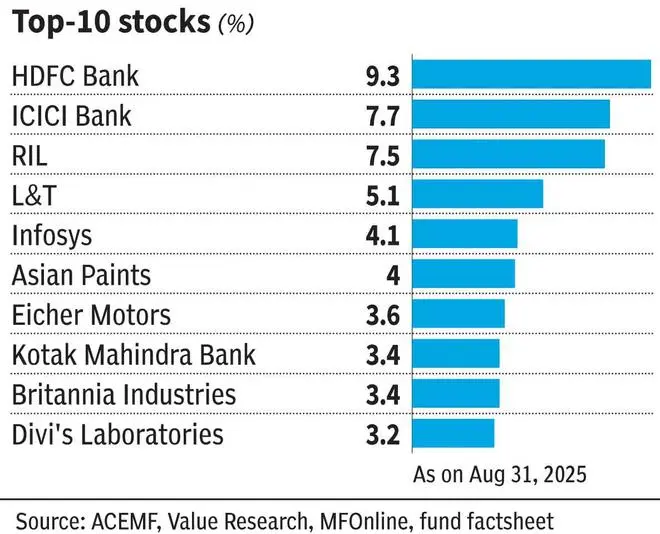

Where SBI Large Cap stands out is in its portfolio construction. Financial services account for nearly a third of the corpus, led by HDFC Bank, ICICI Bank and Kotak Bank. The fund maintains significant exposure to consumption plays such as FMCG, while also holding energy majors like Reliance. Healthcare and IT act as diversifiers, but the fund has resisted overweighting them even during periods of sector exuberance. Stock concentration is contained, with top holdings rarely breaching double digits. This keeps volatility low and makes the scheme less vulnerable to sharp sectoral swings.

Against peers, SBI Large Cap may not always top return charts, but its risk-adjusted performance is sound. Upside capture is 96.5 per cent (category average: 98.6 per cent) while downside capture is 83.9 per cent (category average: 95.2 per cent), indicating that the fund falls less during corrections.

Fund’s ratios such as Sharpe and Sortino also suggest healthy risk-adjusted outcomes compared to the category. For example, a Sharpe ratio of 0.28, above the category’s 0.24, underscores its relatively efficient risk-adjusted returns. Similarly, a Sortino ratio of 0.58, higher than the category average of 0.50, highlights its stronger ability to reward investors while containing downside risks. This balance between modest upside participation and stronger downside protection explains why the fund is better suited for conservative compounding than for investors chasing aggressive alpha.

In essence, SBI Large Cap is not the fund to buy if one wants the thrill of outperformance every year. It is the fund to own if the objective is to anchor a portfolio with stability, scale and predictability. For retail investors with a 5–7 year horizon, this fund, which is rated 4 stars by bl.portfolio Star Track Mutual Fund Ratings, is a reliable core holding.

Published on October 4, 2025