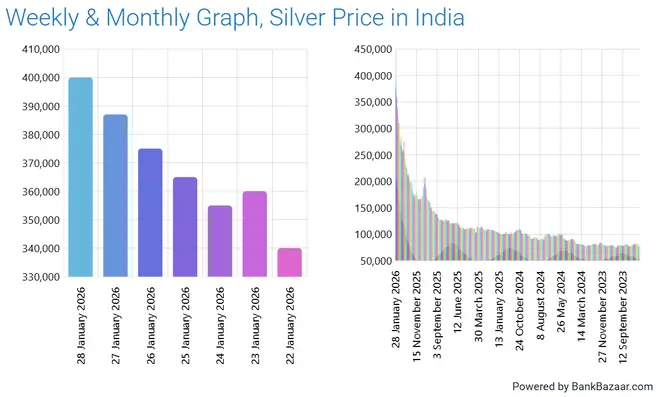

The precious metals rocket ship keeps accelerating into uncharted territory. Gold exploded past $5,600 to touch $5,626 on Thursday, smashing through ₹1.80 lakh in India, while silver broke the psychological ₹4 lakh barrier, marking a staggering 30 per cent year-to-date gain for gold and an eye-popping 66 per cent surge for silver. But as silver “screams” past historical norms, some experts are raising yellow flags about what comes next.

“Gold’s surge beyond $5,600 (₹1,80,000) and silver’s breakout above ₹4,00,000/kg reflect a deepening macro and geopolitical risk premium rather than short-term speculation,” explains Renisha Chainani, head of research at Augmont. The trigger? A combustible mix of Middle East tensions, dollar weakness, and Federal Reserve policy that’s essentially locked rates into accommodative mode.

Geopolitical tensions escalated sharply after President Trump urged Iran to return to nuclear negotiations, warning that “any future U.S. military action would be far more severe.” Iran fired back with threats of retaliation against the U.S., Israel, and their allies, sending shockwaves through global markets and turbocharging safe-haven demand. “This exchange has heightened fears of a broader regional escalation in the Middle East, reinforcing risk-off sentiment,” notes Chainani.

The Fed held rates steady on Wednesday, but Chair Jerome Powell’s acknowledgement of “elevated inflation and an uncertain outlook” while declaring that “rate hikes are not anyone’s base case” has effectively given precious metals a green light. Powell also warned that “the US budget deficit is unsustainable,” adding another layer of fiscal anxiety driving investors into hard assets.

MCX gold has now crossed ₹1,77,000. Ponmudi R, CEO of Enrich Money, sees more upside ahead: “A clear and sustained breakout above the ₹1,80,000 band could quickly open the path toward ₹1,85,000–₹1,90,000, with a psychological extension toward ₹2,00,000 increasingly likely if global momentum sustains.” For silver, he projects targets at “₹4,08,000–₹4,15,000, with scope to extend toward ₹4,17,000–₹4,25,000.”

But here’s where it gets interesting. WhiteOak Capital Mutual Fund just released a report titled “Gold is Talking, Silver is Screaming: A Case for Prudent Repositioning,” warning that silver’s parabolic move “often signals the final, speculative stage of a run.” The Gold-to-Silver ratio has collapsed to approximately 46:1, far below the 10-year average of 80:1. “When it drops below 50:1, silver is no longer cheap,” the report cautions, noting that “in previous cycles, a ratio this low has preceded a mean reversion where silver prices corrected significantly faster relative to gold.”

Ross Maxwell from VT Markets explains the broader dynamic: “Policy uncertainty around growth, trade, and fiscal sustainability tends to pressure the USD increasing volatility expectations. If this environment continues, gold and silver benefit as a softer or range-bound USD would support precious metals.”

The industrial demand story for silver remains robust. “Robust industrial demand, fuelled by rapid expansion in AI infrastructure, data centres, solar energy, electric vehicles, and advanced electronics—has emerged as a key support,” says Ponmudi. He adds that “momentum-driven participation, including FOMO (Fear of Missing Out)-led buying during technical breakouts, has amplified upside moves.”

Rahul Kalantri of Mehta Equities notes that “gold prices have surged more than 10 per cent over the last four sessions” with “investors increasingly shifting away from paper currencies and moving toward tangible assets.” Additional support has come from central bank buying and crypto major Tether’s plans to invest 10-15 per cent in physical gold.

Chainani’s technical view shows “gold sustaining above $5600 (₹1,87,000) opens the door to $5800–6000” while silver’s “decisive move above $118 (₹4,05,000) targets $125–130 (₹4,30,000–4,50,000).”

WhiteOak’s contrarian take suggests investors should “harvest the scream” by taking profits on silver first and rotating gains into diversified Indian equities, which offer better long-term returns and tax advantages. But for now, the precious metals party rages on, fueled by geopolitical chaos, fiscal fears, and a weakening dollar that shows no signs of stabilizing.

Published on January 29, 2026