The markets have been a tad volatile in recent weeks, with uncertainties around interest rate cuts, geopolitical tensions and election outcomes weighing on investor sentiment.

For investors looking to play it safe in the current environment, debt investments with a small dose of equity may be a suitable choice.

In this regard, conservative hybrid funds can be considered by investors with modest risk appetites, as these have delivered double-digit returns over the medium as well as long term. On a post-tax basis, these funds would still comfortably deliver more than the prevailing inflation rate. And these are schemes on low risk.

Market regulator SEBI’s mandate allows conservative hybrid funds to invest only 10-25 per cent of their portfolio in equity & equity related instruments, while 75-90 per cent must be parked in debt securities.

Some of the quality schemes in the category can be considered for lump-sum investments as well as for systematic withdrawal plan (SWP) by those seeking regular income from their corpus.

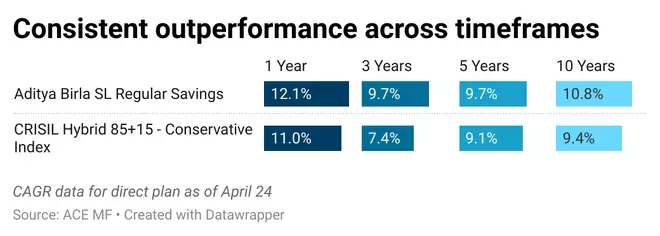

Aditya Birla Sun Life Regular Savings fund (ABSL Regular Savings) can be considered by conservative investors with a three to five-year time horizon. It has delivered above-average returns consistently and has been among the consistent performers in its category. Investing lump-sums may be a good idea in the case of conservative hybrid funds. But investors with a modest risk appetite can consider SIPs (systematic investment plans) for goals that are around five years away.

Steady performance

ABSL Regular Savings fund has been among the top few schemes in its category. When three-year rolling returns over the 10-year period April 2014 to April 2024 are taken, the fund has delivered an average of over 10.5 per cent. This return places it above peers such as HDFC Hybrid Debt, Canara Robeco Conservative Hybrid, Axis Regular Saver and UTI Conservative Hybrid.

In any three-year rolling period over the last 10 years, the fund has not given negative returns.

ABSL Regular Savings has delivered more than 10 per cent over three-year rolling periods over 60 per cent of the times in the last 10 years and more than 8 per cent nearly 78 per cent of the time.

The fund is benchmarked to the CRISIL Hybrid 85+15 – Conservative Index and has managed to beat it nearly 69 per cent of the time on a rolling three-year basis over the last 10 years.

Over the long term, if such funds do manage to give more than 10 per cent returns, even those in the 30 per cent slab may find the returns quite attractive enough to beat inflation.

The fund has an upside capture ratio of 114.2, indicating that it rises much more than the benchmark during rallies. Its downside capture ratio is 65.6, suggesting that the fund’s NAV falls a lot less than the benchmark during corrections. A score of 100 indicates that a fund performs in line with its benchmark.

Combining debt and equity judiciously

In terms of asset allocation, ABSL Regular Savings ensures that the equity part in the portfolio stays at 22-23 per cent levels across market cycles. The fund takes a multicap approach to choosing stocks in the portfolio. Though dominated by large caps (around 14-16 per cent), there is allocation to mid and small caps as well, usually around 3.5-5 per cent each. This approach ensures participation in broader market rallies.

There is a diffused approach to stock selection and very few companies have more than 1 per cent allocation.

In a conservative hybrid fund, the main returns come from debt and equity plays the role of a sweetener and provides a kicker to overall returns.

On the debt side, central government securities dominate the holdings as do AAA-rated instruments of corporates. Sovereign dated securities are the key holdings if the fund. The g-secs maturing in 2030 and going all the way up to securities maturing in 2037 are top debt holdings of the fund.

Then, there are AAA-rated corporate debt securities of Bajaj Housing Finance, REC, PFC, SIDBI, Union Bank of India, Tata Capital, NABARD and Bharti Telecom among a few others.

Therefore, there is hardly any credit risk taken by the fund in any of its holdings and are quite safe. The debt portfolio’s net average maturity is around 5.74 years, which suggests that the fund is betting more on the middle part of the yield curve. The debt part of ABSL Regular Savings has an attractive average yield to maturity of 7.58 per cent.